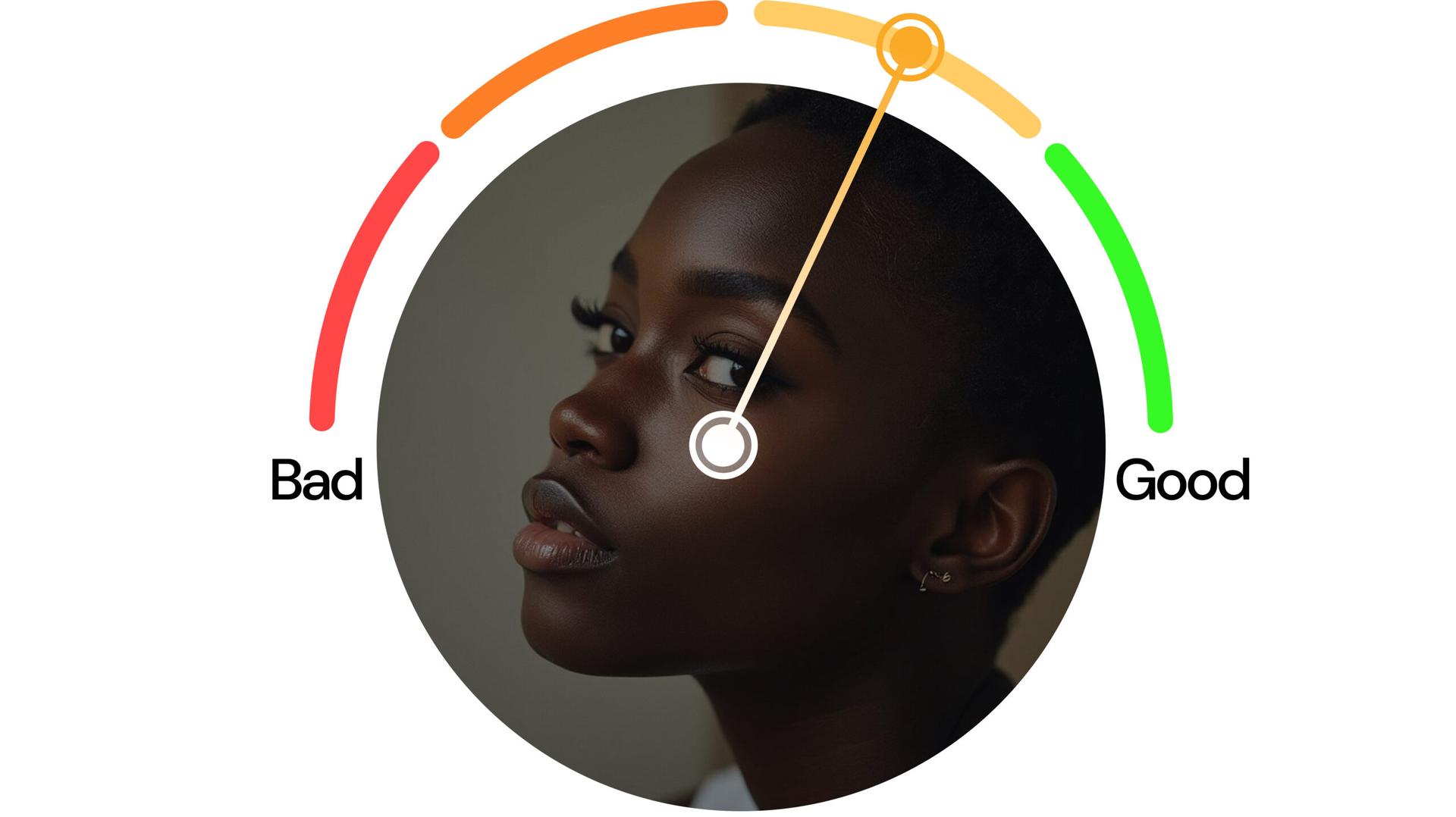

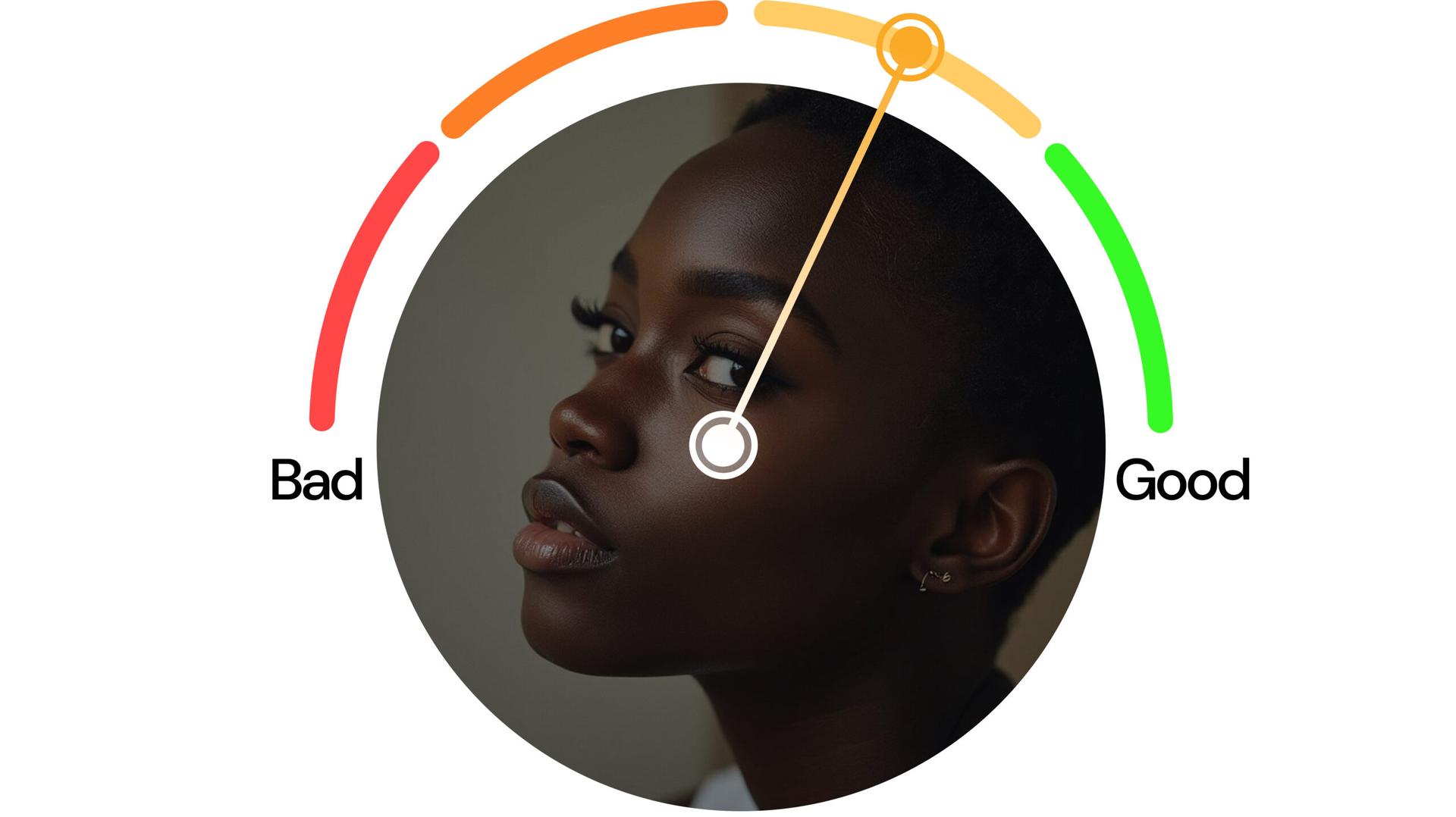

Smart Credit Risk Assessment for Businesses

Designed to empower your business, iziDecisioning leverages AI-driven analysis to assess credit risk accurately, enabling smarter lending decisions and minimizing defaults.

Get Started

Features

Credit Risk & Affordability Assessment

iziDecisioning evaluates borrower profiles using AI-driven analysis to determine creditworthiness, reducing default risks.

Automated Loan Approval

It streamlines decision-making by automating credit approvals based on predefined risk criteria, ensuring faster and more accurate lending.

Benefits of IziDecision

Our suite of solutions is designed and developed to be versatile and powerful, adaptable to your business needs and how you choose to combine them.

Accurate Credit Risk Assessment

Uses AI to analyze financial data and predict creditworthiness with precision.

Faster Loan Approvals

Automates decision-making, reducing processing time and improving efficiency.

Minimized Default Rates

Identifies high-risk applicants, helping businesses make informed lending decisions.

Make smarter decisions for your business

leverage data-driven insights to make smarter choices and drive business success.

Get Started

© 2026 Izifin. All rights reserved.